Contracts are the foundation of business relationships. Minor oversights can lead to financial losses and legal complications.

Without a systematic approach to enforcing contract compliance, businesses risk costly disputes, missed opportunities, and potential penalties.

A contract compliance audit is the solution that helps you spot discrepancies, mitigate risks, and ensure alignment with business goals and regulations.

Let’s dive into what a contract compliance audit is, its benefits and the entire process followed to protect businesses and improve partnerships.

What is a contract compliance audit?

A contract compliance audit is a process in which a business reviews and evaluates whether all the parties meet an agreement’s terms and conditions. Audits evaluate financial commitments, service delivery standards, legal requirements, and performance metrics.

The purpose? To protect your business from costly mistakes like overbilling, non-performance, or even breach of contract claims.

By involving a dedicated audit team and performing contract compliance audits periodically, you ensure that your business stays on track with internal goals and external business agreements. The audit process is not just about finding problems, it’s about strengthening your operations and contractual relationships with vendors and partners.

If you are looking for practical steps to maintain adherence to contractual obligations, this guide to contract compliance provides actionable insights and strategies.

An example of a contract compliance audit

Consider a scenario where your business contracts a vendor for software updates. Over time, you notice a few delays and even the support is not as responsive as promised. Contract compliance audits help you identify these gaps by comparing the vendor’s performance with the contract terms. Such an in-depth audit allows you to pinpoint overpayments, unmet service standards, and areas for improvement.

What are the types of contract compliance audits?

Here is a table with a complete overview of the types of contract compliance audits.

| Types | Description | Purpose |

| Financial Audit | Examines financial aspects of a contract like cashflows, logs, and transactions. | Verified financial terms are adhered to and accurate. |

| Performance Audit | Assesses contract performance to ensure quality and efficiency. | Monitors deliverable quality, standards, and timelines. |

| Compliance Audit | Ensures contract complies with legal, regulatory, and internal policies. | Confirms adherence to legal, regulatory, and governance practices. |

| Operational Audit | Focuses on the operational processes related to contract execution and management. | Identifies areas for operational improvement and alignment with contract obligations. |

| Quality Assurance Audit | Ensures that contracted goods or services meet agreed quality standards. | Verifies product or service quality matches contract expectations. |

| Risk Audit | Analyzes potential risks in the contract and evaluates risk mitigation strategies. | Identifies and addresses risks that could impact contract fulfillment. |

| Supplier Audit | Reviews third-party suppliers or subcontractors’ compliance with contract terms. | Ensures subcontractors meet contract obligations. |

| Environmental and Safety Audit | Verifies compliance with environmental regulations and safety standards. | Confirms adherence to environmental laws and safety protocols. |

| IT and Data Security Audit | Ensures data protection and IT security align with contractual terms. | Protects data and IT infrastructure to meet contract requirements. |

| Legal and Contractual Audit | Checks for legal compliance and adherence to contractual obligations. | Ensures the contract is legally sound and obligations are met. |

Let’s check out the benefits of contractual audits next.

6 Key benefits of contract compliance audits

Here are the key benefits of contract compliance audits.

1. Mitigates contract risks and liabilities

Conducting regular audits is important for effective third-party risk management. Businesses that do not regularly audit contracts risk violations that can lead to penalties, legal disputes, and damaged reputations. Contract compliance audits identify breaches early, allowing corrective actions before issues escalate. This approach helps avoid financial and legal pitfalls and secures your reputation with partners, clients, and regulatory bodies.

2. Reduces costs through billing accuracy and contract adherence

Well-executed contract compliance audits help you identify overpayments, billing errors, and hidden cost drains. For instance, the audit catches these discrepancies if a vendor unintentionally overcharges or fails to apply agreed discounts. Identifying such issues early saves your business from maverick spending and opportunity costs. Businesses improve cost savings and maximize value from every agreement by ensuring every transaction aligns with contract terms.

3. Enhances accountability in contract obligations

Audits build accountability to ensure both parties meet their responsibilities. Such transparency reduces the chances of missed deadlines, neglected deliverables, or quality issues. Businesses meet every contract obligation by consistently holding internal teams and vendors accountable. This approach builds a culture of high standards and ensures all the parties are aligned with expectations.

4. Strengthens vendor relationships with compliance checks

A strong business relationship requires trust and clarity. Regular contract audits improve this trust by ensuring that each party meets their obligations. Vendors, clients, and partners feel secure knowing their contributions are valued, which promotes fair treatment and transparency. As a result, contract audits protect your interests and also strengthen partnerships.

5. Ensures regulatory and contractual compliance standards

Sectors like healthcare, finance, and construction have strict regulatory requirements. Contract audits ensure your contracts comply with these industry standards, which minimizes exposure to non-compliance penalties. Staying compliant also means that your business prevents legal troubles and remains trustworthy in front of the involved parties and the customers.

6. Enables data-driven contract management decisions

Audits generate valuable information about vendor performance, cost savings, and contract value. With such in-depth information, businesses make informed decisions regarding reviewing contracts, adjusting terms, or selecting new vendors. Contract data guides decision-making. This ensures that your agreements align with broader business objectives, optimizing performance and minimizing operational risks.

Streamline Contract Audits with HyperStart

HyperStart uses AI-powered automation to streamline the contract compliance audit process.

A Step-by-Step Contract Compliance Audit Process

Here is the entire process of auditing contract compliance for your business.

Step 1. Define audit scope and gather documents

Clearly defining the scope of the audit ensures that your efforts are focused on the most relevant contracts and areas that require attention. Here are the key tasks to complete during this first step:

Include all relevant contracts and the necessary internal and external parties.

Collect financial records, payment invoices, and any email or letter correspondence related to the contract.

Set clear goals for the audit and define how much time you need to allocate to each step.

By gathering all relevant documentation and ensuring a clear audit scope, you ensure that you are prepared to proceed with the review process. HyperStart allows businesses to organize, store, and track all contract-related documents in one centralized location. This approach simplifies access to and the organization of contract data before an audit.

Step 2. Review contract terms and obligations

The core of the contract compliance audit process includes thoroughly reviewing the contract’s terms and obligations. This step helps ensure that all parties involved are aware of their responsibilities and that the agreed-upon terms are met. A detailed review of all clauses like delivery dates, quality standards, payment schedules, and penalties forms the basis for your performance evaluation.

This includes reviewing any amendments or revisions that impact performance. You also check for terms that influence compliance or results that make the agreement transparent and measurable.

A detailed review identifies inconsistencies that make it easy to assess compliance and pinpoint process improvements. Ensuring that all sensitive data and financial information are handled securely during this review is important for protecting privacy and maintaining regulatory compliance.

Step 3. Compare performance to contractual obligations

After reviewing contracts, compare actual performance with the agreed-upon obligations. This helps identify any deviations from the contract like missed deadlines, unfulfilled service levels, or discrepancies in billing. A performance record helps identify areas that require corrective action. Here are a few key performance indicators to assess.

Verify if deadlines and milestones were met according to the contract terms.

Compare payments with the invoiced amounts and contract terms to spot discrepancies.

Evaluate if the quality of goods or services meets the agreed standards.

Comparing actual performance with such key metrics helps you uncover any compliance gaps.

Step 4. Document findings and recommend actions

Documenting the findings from your audit is important for transparency and to develop a clear action plan. After identifying areas of non-compliance or discrepancies, make sure to offer recommendations for corrective actions. This documentation serves as a reference for existing and future contract compliance.

What to document:

Maintain a detailed record of any discrepancies or deviations from the contract terms.

Provide actionable recommendations on how to address any identified issues.

Suggest specific practices for ongoing monitoring to prevent future non-compliance.

Audit findings can be communicated to the relevant stakeholders for swift course correction.

Step 5. Implement corrective actions and plan for ongoing audits

After documenting the issues, it’s time to implement recommended corrective measures. Effective communication plays a key role in this phase, as internal and external communication strategies are important for maintaining trust and transparency between all contractual stakeholders.

Also, scheduling future audits to ensure ongoing compliance is important during this last stage. This helps identify and address any emerging compliance issues before escalating.

Implement corrective measures as quickly as possible to ensure both parties fulfill their obligation moving forward. Once these measures are taken, plan for ongoing audits to monitor future compliance. Setting up frequent proactive audits and promptly addressing issues creates a framework for ensuring compliance and minimizing future risks.

Ensure Complete Contract Compliance with HyperStart

Stay compliant and reduce risks with HyperStart’s proactive contract compliance solutions.

Perform a thorough contract compliance audit with HyperStart

A comprehensive contract compliance audit is key to minimizing risk and optimizing performance. While conducting these audits becomes complex, using the right tools simplifies the process and improves efficiency.

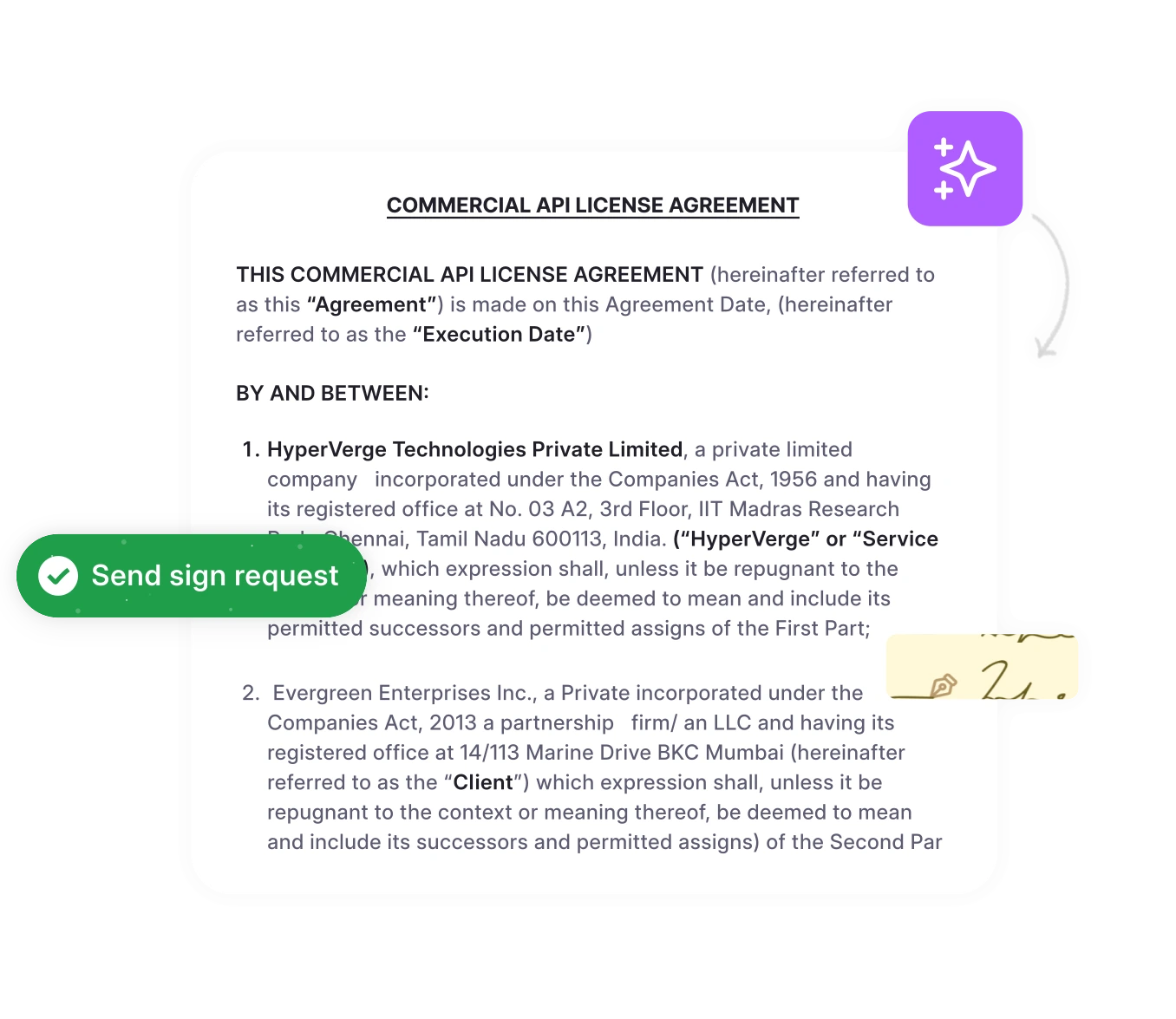

HyperStart is an AI-powered software for contract management that makes the contract compliance audit process a breeze. With automated tracking, customizable checklists, and advanced reporting functionalities, HyperStart helps businesses reduce errors, save time, and maintain compliance with all contractual obligations.

LeadSquared chose HyperStart to optimize its overall contract management process. This B2B SaaS company that automates lead capture, marketing, sales CRM, reporting, and analytics requires a way to manage its growing contract and ensure compliance. Using HyperStart, the company improved its efficiency with a 60% reduction in contract creation time and 92% faster contract reporting.

We took demos of around 5 CLM vendors and chose to go with HyperStart. They were the only CLM vendor who had SOC2 compliance and met the criteria of around 22 parameters which we had evaluated them on.

Om Prakash Pandey

Head of Legal at LeadSquared

If it is time for a thorough contract compliance audit at your organization, HyperStart is the perfect solution. Book your demo today.